Mammoths, Inc.: Nature, Architecture, and the Debt, Part 2

Concerns about moisture and degeneration comprise the brunt and bulk of Sir John Soane’s correspondence with the directors of the Bank of England:

In obedience to your Order—We have surveyed and particularly examined the Exterior Walls of the South Front and East and West Wings of the Bank… We find the Balustrade very much decayed, and the middle part of it dangerous—The upper Stone Work of the Cornice in many places broken and decomposed by successive frosts, and particularly the exposed and projecting parts about the Pediments at the Ends—Some Stones also of the Architecture and Frieze under the Cornice are defective… The Pedestals under the Columns very much defaced by the splitting of their molded parts, in consequence of the rusting of the Ornamental Iron Work which is made … into the substance of the stone instead of merely resting on it… The Defects herein recited are the melancholy effects of time, more or less operative upon all Buildings formed of Portland Stone, such as an examination of Blackfryars Bridge and St. Paul’s Cathedral will abundantly testify—and of a Circumstance not chemically known at that time—that the rusting of Iron would burst asunder the thickness of [?] the walls.1

John Soane was appointed architect of the Bank of England in 1788, a position that he held until 1834, a short time before his death. One knows very little, from Soane’s own words, of the architectural considerations that went into the unique design of the Bank. What determined the choice and shape of the domes in the exchange halls? Why are there no windows on the exterior walls? In all of Soane’s correspondence, one does not find a single word offering an aesthetic rationale for any of the design decisions employed in the Bank. Scholars have more or less had to draw upon his other writing, particularly the Royal Academy lectures, to discern his architectural motives, much of which remains in the realm of speculation. In the client correspondence, though, the one resounding rationale that does emerge, for all the piecemeal improvements and additions that Soane was called upon, or felt called upon, to carry out in his career with the Bank, is degeneration. Degeneration stalks the rafters of the edifice, continually exposing the “extreme thinness of various parts of the … walls” and the “dilapidated state of … the exterior” walls,2 continually occasioning repairs, the work of strengthening, coating, replacement, work that keeps interrupting the normal course of bank business, its own steady cycle interspersed with the cycles and rhythms of finance. As David Watkin has pointed out, Soane was profoundly influenced by Montesquieu, having in his possession three different editions of the collected works of the author of The Spirit of the Laws.3 In the long run, Soane’s shoring up and additions to Robert Taylor’s earlier building would take the exact material trajectory wished by Jefferson for the buildings of America: from timber construction to brick construction.

Worries about climatic blight, the ravages of frost, frozen moisture, also prevail in Benjamin Henry Latrobe—protégé of Thomas Jefferson—fretting about the dome in the Bank of Pennsylvania, a domed structure purportedly inspired by Soane’s exchange halls at the Bank of England:

The cieling [sic] of the Bank of Pennsylvania, having been plaistered so late in the season, of 1800 as to have been exceedingly injured by the Frost, is now in a state absolutely dangerous. Many parts of the same, being ready to fall down, & almost the whole of it is so soft and friable, as to promise no security for its long remaining in the state it is. I therefore take the liberty to recommend its being entirely taken down and replaistered… This work may be performed long before the frost sets, & without interrupting the business of the bank, no time is to be lost, if the work is to be performed this season, and that perhaps no opportunity will again occur in which the business of the Institution may so easily admit of the slight interruption which will be suffered.4

What should a bank look like? What kind of architecture should it have? These questions are seldom, if ever, asked, let alone answered, in the myriad treatises on typology and “character” that form the broad corpus of the modern and modernist architectural canons. This theoretical elision in the entire corpus of a profession may appear particularly puzzling if one considers, on the other hand, the conspicuous rise in the power of banks in modern civic life from the mid-18th century onward. Soane, Latrobe, and Frank Lloyd Wright all built banks, but none of them saw fit to contemplate a modernity emblematized in this particular office.5 Consider the other typologies that architects have addressed as icons of the present in their myriad manifestos: colleges, universities, libraries, town halls, parliaments, merchants’ mansions, country houses and rural cottages, urban apartments, marketplaces and stock exchanges, churches, cemeteries, auditoriums, greenhouses, factories, villages, city gates, custom houses, museums, galleries, barns, worker and other housing, foundries and mints, industrial cities, skyscrapers, hydroelectric dams and train stations. Typological speculations as to each of these institutions have actively been used by architects to insinuate themselves into the capitalist revolutions, if not to ingratiate themselves with private and public patrons. Nowhere, on the other hand, in the entire gamut of the architectural canon on functionality and form—Perrault, Piranesi, Diderot and d’Alembert, the Adams, the Blondels, Ledoux, Laugier, Chambers, Durand, Rondelet and Blouet, Pugin, Viollet-le-duc, Howard, Garnier, Wright—does one see an exploration into the bank as a separate programmatic type. Daniel M. Abramson has instead described the broad trajectory of bank architecture as a type that was routinely deconstituted into a combination of attributes or parts–the house, the hall, the temple, the vault, and office–with each part occasioning distinct aesthetic or symbolic attention.6

In Jefferson’s quest for the mammoth, one has seen a developing anathema within the Enlightenment against the institutionalization of the debt, posed on this side of a metaphysical question. Is it that this philosophical obduracy precisely sets up, and is mirrored in, the architectural lacunae above, in their mutual preclusion of banks as an institutional type? As a negative and abstract entity, it is as if the debt can have no customized architecture: In its sponsorship of the democratic era, finance seems to operate as a kind of dream world—the buried unconscious of the liberal universe. In early America, prejudices against debt and money expressed themselves as a kind of urban camouflage: Most bank buildings of the early republic were modest, often occupying prosaic buildings built for other purposes. When banks did seek to express their institutional power, it was through the choice of an ecumenical neoclassicism, more reflective of their aspirational civic status rather than of the activities within. The Renaissance symmetry of Ledoux’s unrealized project for the Caisse d’Escompte or National Discount Bank of 1778–80—Jacques Necker’s abortive attempt to establish a national debt holding institution like the Bank of England on the eve of the Revolution—is markedly at variance with the semiotic literality of vocation expressed in the whimsicality of his Chaux renderings.

Abramson has argued that the Bank of England’s particular failure to spawn imitations in its wake “was a function of Soane’s disinterest in creating specific and legible typological character.”7 It is possible that this disinterest also reflected the Bank’s own haphazard rise to prominence, an uneven history that includes, during Soane’s career with it, the currency run of 1797 when the war with Republican France drained its bullion reserves, resulting in William Pitt’s Bank Restriction Act codifying the circulation of paper money in lieu of specie.8 In this sense, Soane’s design skills were called upon, more often than not, to provide stylistic continuity for what were in fact a series of piecemeal additions, a section here, a room there. His role better resembles that of in-house decorator, employed on account of his professional reliability and economy of services provided, commissioned to carry out corrective, augmentative interventions and embellishments rather than raise an edifice de novo.

In a manner of speaking, Soane’s own persona impeccably mirrored the Bank’s own parvenu-like path to prominence. He began his career in the country, designing country houses for the landed gentry (including Holwood, the estate of William Pitt);9 his arrival in London was decidedly in the mode of an arriviste, having married into wealth, upon which John “Soan” added the unpronounced, but presumably gilded, vowel to his last name. As Abramson has pointed out, Soane remained profoundly ambivalent about his retention by what was in his eyes a “mere commercial corporation,” looking instead to aristocratic and state patronage to burnish his aspiration to professional honor.10 This was equally true of the Bank’s directorate prior to the Soane era, most of whom craved the status conferred upon the landed elite; the decision to hire the young, ambitious Soane reflected a newfound ambition to assert their institutional presence, “assum[ing] more visible cultural profiles than had their predecessors … [and by hiring] skilled, professional and fashionable architects to complete renovations and expansions on their homes and businesses.”11 This devotee of the ancien régime remained ever disappointed that his reputation and financial success in London rested as much on his architectural commissions as on a slew of other duties—surveying, assaying, maintenance, land speculation—which he undertook to carry out on behalf of his clients. Like the money in the Bank of England, Soane’s stock in trade was his personal reputation, a persona that, as Timothy Hyde has shown, he zealously guarded through litigation and otherwise.12 Soane’s artistry as an architect must then be seen as something of a cameo within a larger and ecumenical professional profile, whose respectability rested somewhat on muting or eschewing any strong aesthetic preferences or formal dogmas. The “disinterest in creating specific and legible typological character,” in other words, is of a piece with the compulsions of building up a lucrative practice, as are the bromidic and dilettantish meanderings of the Royal Academic Lectures. At best, these afford for the reader the uncontroversial, “middling aesthetic,” and sensuous empiricism that has been recounted above in the 18th-century aesthetics of Francis Hutcheson and Kames.13

In Soane’s Bank of England correspondence, this cameo-like role of the architect is further accentuated by the accent placed on certain words: “Some Stones also of the Architecture and Frieze under the Cornice are defective.” Without exception, the word “Architecture” is capitalized in all of Soane’s letters, the demarcation indicating a distinct budgetary item from the other building services requisitioned by the Bank. Everything that is talked about in the Royal Academy lectures—the classical orders, the appropriate uses of ornament, the discourse on character, the proper emulation of the ancients—is here circumscribed and delimited within the bracket of a separate, and separable, fiscal outlay, detaching the business of aesthetics from the business of making buildings stand up, of ensuring that walls are perdurable, and so on. Once again a bicameral, duplex universe confronts us, on the one hand composed of an eternal confrontation between matter and climate, and on the other hand, the autonomous—differently priced—scene of culture and reason; once again, the former, the imperatives of natural cause, presses across the boundaries of this strife into a more muted, circumscribed ambit for the latter.

We would be remiss not to notice the shifting frame of value posed by the historical fates of the Newtonian universe. Even as the “noble” tactility of gold and silver species appeared to wither away into the wagers and fortuities of paper money, this material dissolution, on the other hand, only seemed to further and further shore up the Bank of England’s own institutional stature, its need to expand more and more into its surrounding estates, to better shore up its rotting timbers, and to better embellish its appearance with finer and finer Architecture. The dueling worlds of firmitas and venustas both find patronage in the very core of the financial revolution. Soane’s seemingly archaic preoccupation with degeneration represents nothing else but yet another actuarial exercise in an increasingly “financialized” world.

Consider, then, that one finds no such prior preoccupation with material durability in the Bank’s building documents prior to Soane’s tenure. Robert Taylor’s original building of 1764 had decayed within 30 years of its completion; Taylor’s own correspondence hardly mentions any qualms regarding decay or degeneration as a criterion for his building. Counterintuitive as this might be, I would argue here that Soane’s concern with decay in fact reflects in the first instance the imprint of an ongoing shift in scientific rationales. More to the point, this concern is through and through entangled within the extension of that rationale into the core of the financial revolution, which is to say the extension of mathematical reason into a growing institutionalization of risk. If for Jefferson the solidity of brick construction appeared to be the commonsensical recourse against the short-term recourse to cheap, flimsy construction, in Soane’s case one can discern that same common sense as being paradoxically supplemented by the growth, in the aftermath of the Seven Years’ War (1756–63), of the very speculative industry that Jefferson’s “epistemological modesty” would excoriate: insurance. By a further paradox, it was precisely the increased mathematical computability of financial risk to which, in his role as assayer, Soane’s archaic concern for his own professional reputation also provided a rider. The document extracted below should cue one into this shift:

And it is hereby further enacted, That every front, side, end or other external wall, (not being a party-wall,) which shall, after the twenty-fourth day of June, in the year of our Lord one thousand seven hundred and seventy-four, be built to any first rate building, or to any addition thereto, or enlargement thereof, shall be built and remain, at the foundation thereof, of the thickness of two bricks and an half in length, or one foot nine inches and a half at the least; and shall from thence regularly and gradually diminish on each side of the wall two inches and a quarter to the top of the footing of every such wall, except where any immediate adjoining building will not admit of such footing being made on the side of such wall next such [sic] adjoining building; in which case such footing shall be made as near to the dimensions herein directed as the case will admit…14

These stipulations are taken from An Act for the further and better Regulation of Buildings and Party-Walls, and for the more effectually preventing Mischief by Fire, within the Cities of London and Westminster. Passed by Parliament under George III in 1774, it was the first major law establishing general standards in the quality of building, subsequently called the “Black Act” by artisans because of the strong strictures imposed on them within it.15

Fig. 5.

Front page of John Matthews, An Abstract of the Act of Parliament made in the Fourteenth Year of his Present Majesty King George III (London: W. Strahan and M. Woodfall, 1774).

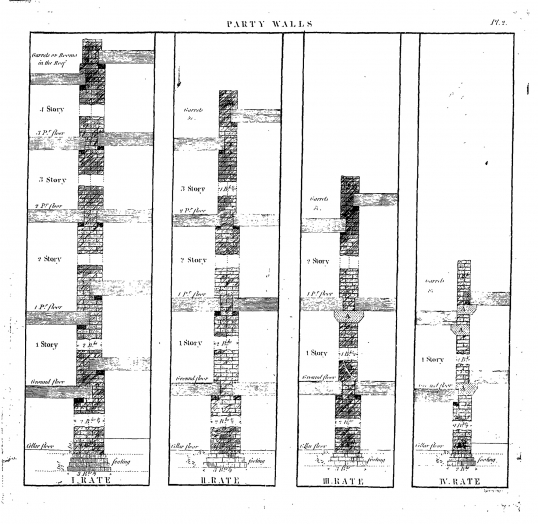

Fig. 6.

“Party Walls,” sectional illustrations from John Matthews, An Abstract of the Act of Parliament made in the Fourteenth Year of his Present Majesty King George III (London: W. Strahan and M. Woodfall, 1774).

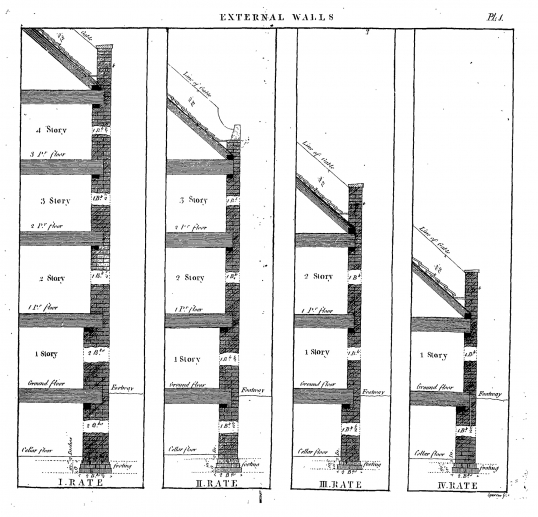

Fig. 7.

“External Walls,” sectional illustrations from John Matthews, An Abstract of the Act of Parliament made in the Fourteenth Year of his Present Majesty King George III (London: W. Strahan and M. Woodfall, 1774).

An abstract, global logic of performance now intervenes in what previously remained implicit in the sphere of customary contract, thus providing the surveyor and assayer with a new apparatus of control over the practices of bricklayer and carpenter. It goes without saying that Soane was no stranger to the conflicts posed by this Act, confronting, at several times in his career, many cases of “insubordination” from bricklayers who refused to comply with his specifications.17 Let us not mistake the revolutionary implications of this development: What is being inserted right into the core of artisanal work is a new calculus of value, whose logic drew more from a new dynamic of wealth rather than from any particular shift in architectural taste or technological paradigm. Subsequent scholarship has somewhat lazily described the 1774 Act as a response to the Great Fire, an absurd conclusion that little regards the fact that the fire preceded it by 100 years. Far from merely being a belated reaction to that “act of nature,” the 1774 Act represented rather the rising power—commensurate with the expansion of state-backed credit markets in mid-18th century18 —of insurance firms and their attempt to secure larger markets within the building industry. Pointedly, the surveyor John Matthews’ construction drawings for his précis were accompanied by tables of mortality and the indemnities incurred by builders within the precincts of London, the very class of information on which William Petty, Condorcet, Buffon, and Jefferson had cut their analytical teeth.

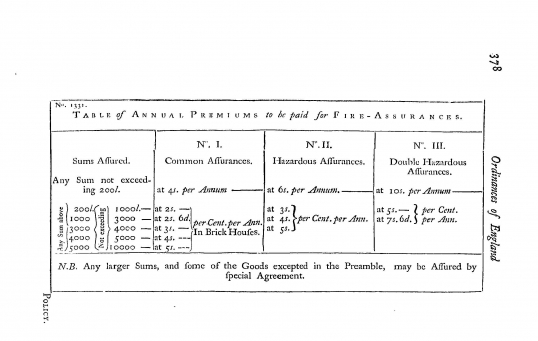

Fig. 8.

“Table of Annual Premiums to be paid for Fire-Assurances,” from John Matthews, An Abstract of the Act of Parliament made in the Fourteenth Year of his Present Majesty King George III (London: W. Strahan and M. Woodfall, 1774).

On the same lines, even as Soane resolutely exploited the new technocratic powers conferred by the 1764 Act to build the bulk of his professional career, one can see in his thought an equally resolute divorcing of the sensory apparatuses governing—the separately budgeted—Architecture from the new mathematical and technical constraints being placed on building per se. We pass over, (since it has been more authoritatively addressed elsewhere) in the form of a note, Soane’s famous failed suit for libel over the very question of thickness and thinness, of solidity and flimsiness, in his renovations to the Bank of England’s Rotunda. Abramson describes Soane’s career at the Bank as a 40-year exercise in heating and fireproofing experiments, complemented by similar exercises by the Architects’ Club, Britain’s first professional association of architects, founded by Soane and other prominent architects in 1791. The new Rotunda design, for instance, “featured thickened, fireproof, Portland stone walls carrying a heavier, incombustible, rot-proof brick dome.”20 Soane’s professional umbrage, on the other hand, was roused by aspersions that the attenuated and spare ornament in the Rotunda traduced the classical standard—“defiance hurled at Rome and Greece”—in not conveying the right sense of stability.

Despite his continual solidifying of every structure that he undertook, Soane himself continued to emphasize (e.g., in Lecture VII of the Royal Academy lectures) “solidity” as an architectural value owed to the demands of beauty and symmetry, a quality of Architecture rather than construction per se. David Watkin explains this emphasis as drawing from 18th-century theories of decadence, a claim he substantiates on the basis of the heavily annotated copy in Soane’s library of Charles-François Viel’s Décadence de l’architecture à la fin du dix-huitième siècle.21 What I have suggested above is that the theory of degeneration in fact signals a massive epistemological rift between the primacy of (conceptual) systems and the primacy of the senses, and that Soane’s intellectual habitus remained immured in the latter while in fact reaping profits from the growing powers of the former.

It was Walter Benjamin who had pointed out, in his Convolute F—later labeled as “Iron Construction”—the significance of Viel’s stance in his 1805 De l’impuissance des mathématique pour assurer la solidité des bâtimens. Benjamin described this work as a last-ditch, “extremely violent, comprehensive polemic against static calculation” and technical absolutism to come in the 19th century, a polemic against, to use another Benjaminian expression, a looming disenchantment of architecture.22 Hence, Viel’s—and Soane’s—emphasis on proportion against calculation, fitness versus science, on monumentality against mathematics. The reproof is as much against the actual veracities of the science as its use in fostering a prosaic actuarialism that is increasingly seen to pervade Architecture in all its pores. Think, then, of Viel, here, in the long shadow of the Leibniz-Clarke debate:

…il est incontestable que les principes de la construction, établis sur des bases aussi solides que celles que je présente, garantiront de toute méprise dans l’exécution des bâtimens, et leur procureront la plus longue durée dont les ouvrages dont les ouvrages des hommes soient susceptibles. Il est incontestable que les principes hypothétiques, que la science des infiniment petits, des infiniment grands ne peuvent être un préservatif contre l’erreur, dans la construction des édifices les plus importans, de toute nature et de toute espèce.23

What used to be “discommodity” in the antiquarian frame is now being subject to a modern science of error.24 Thus, even as Soane’s entire professional career at the Bank of England can be said to be premised on this new mathematical imperative, one can see in his covering over the new regulative criterion by recourse to an antiquarian theory of sentiment, a studied aversion to that very body of new knowledge. It is through this riven mix of radical knowledge and ancestral sense that perhaps one should also view Soane’s associate, Joseph-Michael Gandy’s famous renderings of the Bank of England.

Fig. 9.

Joseph Michael Gandy, Soane’s Bank of England as a Ruin, 1830.

✓ Transparent peer-reviewed

Arindam Dutta, “Mammoths, Inc.: Nature, Architecture, and the Debt, Part 2,” Aggregate 2 (December 2014), https://doi.org/10.53965/ASRH7672.

- 1

I am extremely indebted to Daniel M. Abramson for his work on this subject, his generous pointers regarding Soane archives, and lastly his careful reading of my manuscript. Research for this paper was carried out at the Research Library at Sir John Soane’s Museum in London and the Historical Society of Pennsylvania archives in Philadelphia. I am grateful to personnel in both these institutions for their generous assistance. Letter by Soane to Directors of the Bank of England, [n.d.] approx. Dec. 1814 or Jan. 1815, John Soane Archives, The Soane Museum and Archive, Box 14 – Set LXV.

↑ - 2

Letter by John Soane to Building Committee, May 30, 1823, Bank of England Archives, Document No. M5/262 Vol. No. 3, 28–32.

↑ - 3

David Watkin, Sir John Soane: Enlightenment Thought and the Royal Academy Lectures (Cambridge: Cambridge University Press, 1996), 157–59.

↑ - 4

Letter by Benjamin H. Latrobe, To the Presidents and Directors of the Bank of Pennsylvania, Aug. 10th, 1808. Historical Society of Pennsylvania Archives, Philadelphia, Document no. Bd 615 L 354.

↑ - 5

See Charles Belfoure, Monuments to Money: The Architecture of American Banks (Jefferson, NC: McFarland, 2005); Kenneth Hafertepe, “Banking Houses in the United States: The First Generation,” Winterthur Portfolio, Vol. 35, No. 1 (Spring, 2000); Robert L. Alexander, “The Union Bank, by Long after Soane,” The Journal of the Society of Architectural Historians, Vol. 22, No. 3 (Oct. 1963).

↑ - 6

See Daniel M. Abramson, “A History of Bank Architecture: The House, the Hall, the Temple, the Vault, and the Office,” in Bank and Architecture: Banque Bruxelles Lambert – Geneva, Mario Botta, Architect (Geneva: Electa and Banque Bruxelles Lamberte, 1998).

↑ - 7

Daniel M. Abramson, Building the Bank of England: Money, Architecture, Society, 1694–1942 (New Haven: Yale University Press, 2005), 187. For a general schedule of Soane’s history at the Bank, see Eva Schumann-Bacia, John Soane and the Bank of England (New York: Princeton University Press, 1991).

↑ - 8

See Mark Crosby, “The Bank Restriction Act (1797) and Banknote Forgery.” BRANCH: Britain, Representation and Nineteenth-Century History. Ed. Dino Franco Felluga. Extension of Romanticism and Victorianism on the Net. http://www.branchcollective.org/?ps_articles=mark-crosby-the-bank-restriction-act-1797-and-banknote-forgery, accessed June 15, 2013.

↑ - 9

Both Soane and his assistant Gandy produced portfolios on this aspect of their work. See John Soane, Sketches in Architecture, Containing Plans and Elevations of Cottages, Villas, and Other Useful Buildings with Characteristic Scenery (London: Taylor, 1993); also see Ptolemy Dean, Sir John Soane and the Country Estate (Aldershot, England: Ashgate, 1999).

↑ - 10

“Soane, however, could never fully embrace the commercialization of Georgian architecture. Its monetized social and professional relations disconcerted him. Public discourse and speculative building practices threatened him. Indifferent state patronage discouraged him. Throughout Soane’s life the older academic and dynastic models of architectural identity and reproduction—exemplified by Chambers, Sandby, and the Holland and Dance families—remained Soane’s highest ideals, as did the great dream of exalted royal patronage. By 1790, Soane had gained financial security through an inheritance to his wife, Elizabeth, and had two young sons, John and George, to raise his dynastic hopes. He was an apparent success. But it was honor not wealth that Soane craved above all else in the commercialized world of British architecture. This was why Soane was so disappointed at having failed to gain a royal post at Greenwich, instead of the job he did get at the Bank of England, a mere commercial corporation in the architect’s eyes.” Abramson, Building the Bank of England: Money, Architecture, Society, 1694–1942, 101.

↑ - 11

Abramson, Building the Bank of England: Money, Architecture, Society, 1694–1942, 96.

↑ - 12

See Timothy Hyde, “Some Evidence of Libel, Criticism, and Publicity in the Architectural Career of Sir John Soane,” Perspecta 37: “Famous,” The Yale Architectural Journal.

↑ - 13

See Peter Kivy, The Seventh Sense: Francis Hutcheson and Eighteenth-Century British Aesthetics (Oxford: Oxford University Press, 2003).

↑ - 14

An Act for Regulating of Buildings and Party-Walls, and Preventing Mischiefs by Fire, in London and Westminster, Passed in the 14th Year of George III, illustrated with Plates, shewing the Proper Thickness of Party-Walls, External Walls, and Chimnies, with a Complete Index and List of Surveyors (Cambridge: J. Burgess, 1796), 2–3.

↑ - 15

The title of the original act is evocative. John Matthews (Surveyor), An Abstract of the Act of Parliament Made in the Fourteenth Year of the Reign of his present Majesty, King George III, Intitled, An Act for the further and better Regulation of Buildings and Party-Walls, and for the more effectually preventing Mischief by Fire, within the Cities of London, and Westminster and the Liberties thereof, and other the Parishes, Precincts and Places, within the weekly Bills of Mortality, the Parishes of Saint Mary-le-bone, Paddington, Saint Pancras, and Saint Luke at Chelsea, in the County of Middlesex; and for indemnifying, under certain Conditions, Builders, and other Persons, against the Penalties to which they are or may be liable for erecting Buildings within the Limits aforesaid contrary to Law, Calculated for the Use of Builders, and Workmen in General (London: W. Strahan, 1774).

↑ - 16

“…early drawings, composed of thin, uniformly inked ruled lines, were generally done to a small scale and included very little detail. Some included dimensions and indications of material, but many did not. Decisions like the profile of moldings, the trim around windows and doors, and the design of decorative brick work were left to the discretion of the builder or made during the construction process through informal consultation. This abbreviated design process was possible because of the nature of eighteenth and early nineteenth century aesthetic assumptions and building practices. Construction technology for all types of structures and the design of vernacular buildings were based on traditional building practices that required little explanation among the parties involved. The design principles that guided more formal Georgian and Federal architecture were based on Palladio’s theories of symmetry and hierarchy enriched with classical elements chosen from English design manuals and pattern books. These principles and sources were well understood and familiar to both client and builder.” Lois Alcott Price, “Line and Shadow: The Role of Ink in American Architectural Drawings Prior to 1860,” The Book and Paper Group Annual, Volume 13, 1994, The American Institute for Conservation, http://aic.stanford.edu/sg/bpg/annual/v13/bp13-08.html, accessed June 15, 2011.

↑ - 17

The following, what appears to be a letter of complaint from a bricklayer, found in the Soane archive, might be illustrative: “At the time the Boundary Wall rear Buildings from Bathw Lane to Princes St. Barnes attended at times to the gutting up the Foundation and I Recd. Xxx—from Mr. Soane to work the wall Particular Sound Mr. Barnes Contradicted those Orders and Told the Bricklayer that Rubbing up the Joints was Damn’d Nonsense—if they did not mind what he said to them he would send them out of the Work. One Day Mr. Soane and Mr. Dance Came in the Works and Caught the Bricklayers laying the Brick in the Wall … the Circular Course on Princes St. without either Mortar in the Joints or Bed. Mr. Soane Immediately stopped the men from working & called for me and I asked the Bricklayer who gave them order to lay the Brick in that manner they informed Mr. Soane it was Barnes. Mr. Soane send for Barnes But Mr. Poynder Appeard instead But Mr. Soane insisted on Barnes being brought forward and from that time Mr. Soane Orderd that Barnes should never be seen about the works any more. Ever since that Time Barnes has Continually made use of very Improper Language both to me and the Bricklayers that is in the Employ.” Letter signed Henry Harrison, dated January 8, 1806. Soane Museum Archives, Box 14, Set LXV.

↑ - 18

Insurance companies invested the bulk of their assets of insurance companies in governmental securities, as well as in the East India Company and the Bank of England. See Barry Supple, The Royal Exchange Assurance: A History of British Insurance, 1720–1970 (Cambridge: Cambridge University Press, 1970), 73. Also see C.G. Lewin, Pensions and Insurance before 1800: A Social History (East Linton, Scotland: Tuckwell Press, 2003). Both have chapters on fire insurance.

↑ - 19

Nicolas Magens, An Essay on Insurances, Being a Collection of All the Foreign Ordinances of Insurances, and Forms of Policies, translated into English, with Remarks on such Parts as are obscure or defective; all the English Acts of Parliament relating to Insurance, Shipwrecks, Salvages, and Insurance-Companies; the Forms of Policies and Bottomry Bonds; the Conditions of Insurance against Fire, & c. (London: J. Haberkorn, 1755).

↑ - 20

Abramson, Building the Bank of England: Money, Architecture, Society, 1694–1942, 107–108.

↑ - 21

Watkin, Sir John Soane, 159.

↑ - 22

Walter Benjamin, The Arcades Project, trans. Howard Eiland and Kevin McLaughlin (Cambridge, MA: The Belknap Press, 1999), 158.

↑ - 23

Charles-François Viel de Saint-Maux, De l’impuissance des mathématique pour assurer la solidité des bâtimens et recherches sur la construction des ponts (Paris: Tilliard, 1805), 69.

↑ - 24

On the sensibility and politics of error in this period, see David W. Bates, Enlightenment Aberrations: Error and Revolution in France (Ithaca: Cornell University Press, 2002).

↑ - 25

See Nina L. Dubin, Futures and Ruins: Eighteenth-Century Paris and the Art of Hubert Robert (Los Angeles, CA: The Getty Research Institute, 2010).

↑